Fast Payday Loans

Fast Payday Loans Online

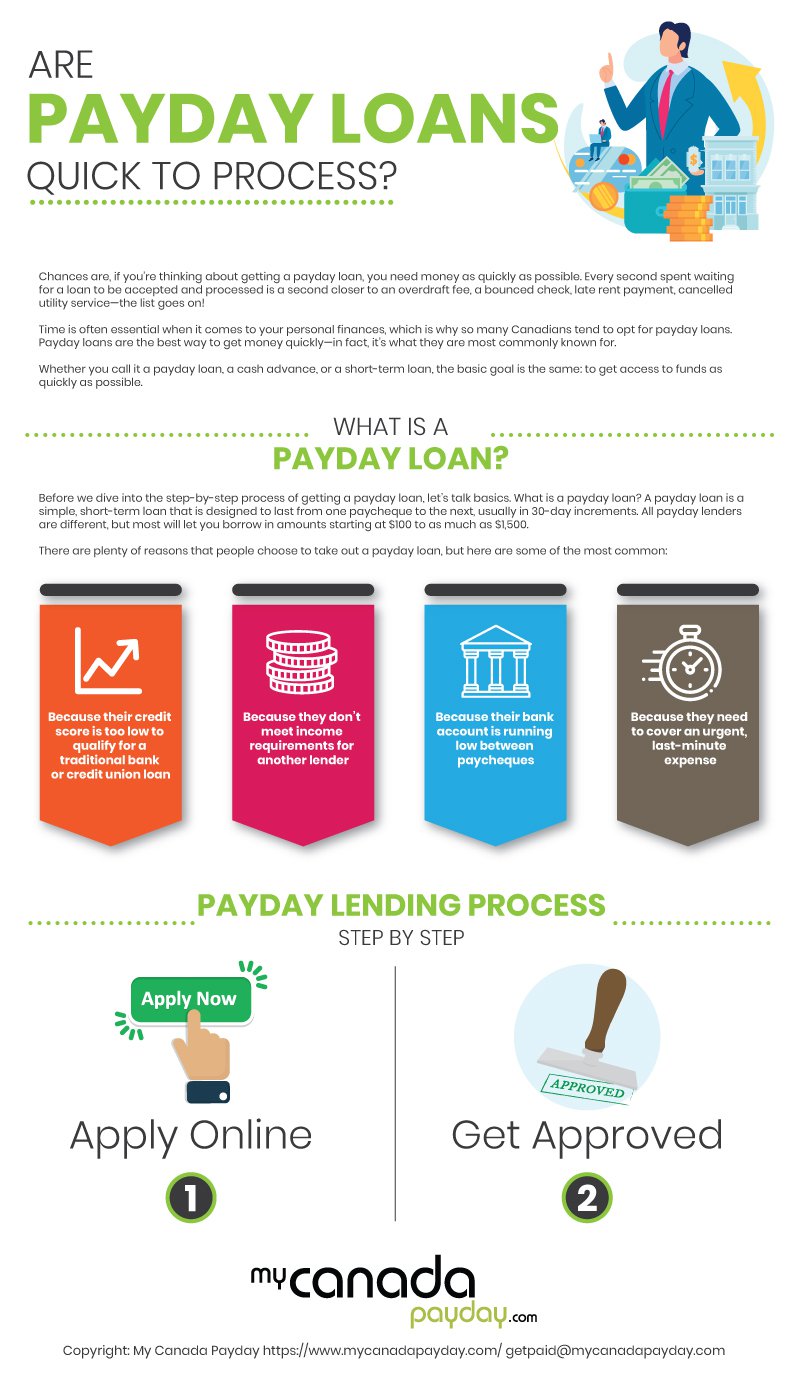

When you are in need of cash fast to pay for bills, medical expenses or other emergency situations, it can feel stressful and overwhelming to handle. Fortunately, there are a few options available depending on your location, qualifications and the amount of cash you are seeking to get in advance. If you are currently employed and you can provide proof of income, fast payday loans may be the right choice for you and your situation.

What is a Payday Loan?

A payday loan is a loan that is provided to an individual who is currently employed and can show proof of income on a regular basis. Payday loans allow you to get cash in advance for a set period of time which must be paid back by a set date to avoid additional fees and penalties. Many times, payday loans require you to pay an interest rate that is often determined by your credit or financial history and current situation.

Why Are They So Fast?

Banks offer a wide array of credit products, so their approval process has to be highly flexible. This flexibility comes at a cost, as it adds layers of complexity. When your loan application enters a traditional bank's underwriting process it will end up shuffling between several different departments and assessment officers before it reaches the right person. Each person will have to read the application and make a decision on its individual merits before forwarding it down the line. All this work comes at a cost, which can be easily recouped on a $500,000 mortgage, but can be more difficult on a $200 loan where they can only charge somewhere close to prime. Payday lenders specialize in a very small segment of the credit market, allowing them to streamline their processes to make small loans affordable to offer. How fast are they? In fact, My Canada Payday offers virtually instantaneous loans. That's right, after approval funds arrive in just minutes.

Who Can Take Out a Payday Loan

Access to payday loans is available to any individual who is legally employed or on a pension and can provide reasonable evidence of that income. This generally means either a consistent record of payments or pay stubs, but exceptions are sometimes made for existing customers who have irregular income streams such as teachers or other seasonal workers.

Uses of Payday Loans

There are many uses of payday loans as many payday offices and services do not place restrictions on why payday loans may be taken out or requested. Payday loans are ideal if you have unpaid bills that are overdue, medical emergency expenses, or basic necessities like food. Taking out a payday loan for an investment is generally not a good idea as the interest rates are usually higher than any normal investment would be likely to generate.

Before Getting a Payday Loan

Before you begin considering taking out a payday loan for any reason it is important to assess your current financial situation, any bills you have and upcoming payments that may be due in addition to paying back the loan you want to receive. Understanding whether or not you can pay the payday loan back in full by the date of your next paycheque is really essential due to the penalties for overdue payments. A single missed payment can end up costing you a lot of money unless you notify the lender beforehand to reschedule your payment.

Benefits of Payday Loans

Payday loans allow you to get the cash you are in need of anywhere from a few hours to just a few days. With payday loans it may be possible to take out a loan regardless of your current financial situation and your past credit scores depending on the amount of money you plan to take out and your proof of income and employment. Payday loans can also be used to purchase or pay for just about anything, giving you free reign over the money as opposed to taking out loans from bigger institutions including banks.

Searching for a Payday Loan That is Right for You

Finding a payday loan that is right for can be done by checking with local payday loan services and offices in addition to also conducting a bit of research online. Online lenders are usually able to service the entire country, which gives you a significant amount of choice. Looking for a payday loan company that is right for you online can help you to find a service that provides the type of loans you are seeking at an interest rate you are capable of affording.