How To Improve Your Credit Score

More Resources

- How Credit Scores Are Calculated

- How To Improve Your Credit Score

- TransUnion Versus Equifax

- How to Read a Credit Report

- 15 Steps To Improve Credit Score | Get An 800+? |

- What Credit Score Do You Start With: The Ultimate Credit Guide

- Learn How To Understand Credit Score Drops and Changes

Table of Contents

Your credit score is one of the most important measures of your overall financial health. The higher your score, the more likely it is that you will be able to get approved for a credit card, car loan, mortgage, or even a business loan. Not only that, but an employer may also check it before hiring you or a landlord before signing a lease. Those with higher scores enjoy lower interest rates on loans which can save thousands of dollars, or more, over the course of the loan.

If you have had some credit issues, or have a new credit profile, raising your score can seem like a daunting task. Your credit score is calculated using a proprietary formula based on data on your credit report. Lenders report the status of your debts monthly to two credit bureaus, Equifax and TransUnion, and your score can change daily as new data comes in.

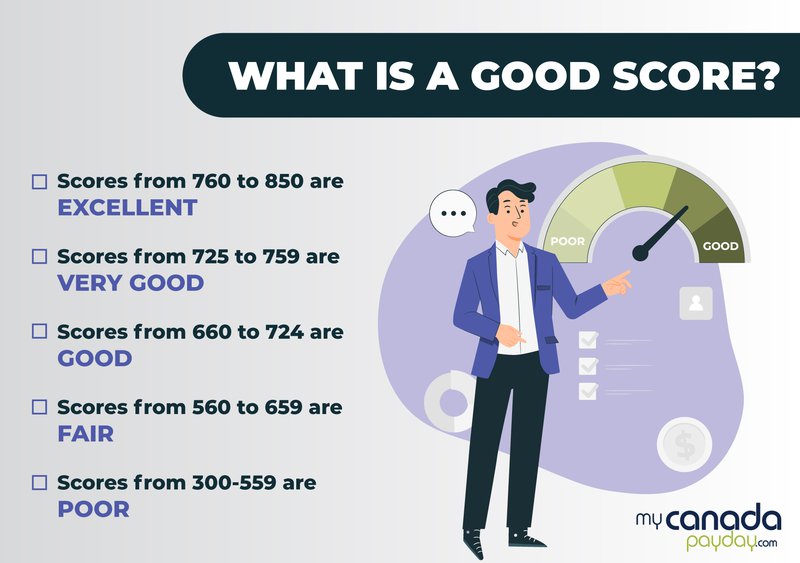

What is a Good Score?

Your credit score is a three-digit number between 300 and 850. The higher the score, the more likely you are to get approved for loans and other credit with favourable terms and interest rates. Your score is a measure of statistically how likely it is that you will repay your loan on time. While both the major bureaus use the same range of scores, there are differences between the two even though the meanings are approximately the same.

There are no exact cut-offs between what is a good score and a bad score, but they can be broken down into ranges that banks will use to judge your creditworthiness.

- Scores from 760 to 850 are excellent

- Scores from 725 to 759 are very good

- Scores from 660 to 724 are good

- Scores from 560 to 659 are fair

- Scores from 300-559 are poor

Each lender has its own criteria, but if your score is below 560, you will have a very difficult time getting approved for any type of credit. If you are above 660, you will generally be able to get approved for any loan, whether it is a credit card, car loan, or even a mortgage, although you may have to put down a larger down payment and pay a slightly higher interest rate. If you are above 760, your score will be high enough to get you approved for the loans with the best terms and lowest interest rates.

It is also worth noting that once your score is above 760 or so, there really is no reason to try to get it any higher. Your score will gradually rise above 760 with time as long as you are wisely using your credit, but many people try to open a bunch of credit cards in order to “hack” the scoring algorithm into giving them a higher score. There really is no benefit to doing that, as your score is already high enough to get any loan approved. The limiting factor will be aspects of your financial profile such as income or debt to income ratio. By applying for a bunch of credit cards just to get your score close to the 850 mark, all you are really doing is creating a bunch of unnecessary work for yourself.

Steps to Improve Your Score

Even though the exact formula is secret, we do know roughly the main components of the score. Follow these suggestions to maximize your score.

Check Your Credit Report

The first thing you should do is to check your credit report. You can download a free copy of your credit report once per year. You will want to look over your report for any errors and to make sure everything is being reported accurately.

You can dispute any errors online or by mail. By law, the credit bureau has thirty days to either correct and verify the information or have it deleted. Checking your own credit report counts as a “soft inquiry”, so it will not affect your score.

Pay All Of Your Bills On Time

One of the most important things you can do to maximize your score is also one of the simplest. By far the worst thing that can show up on your report is a late or missed payment, and they stay on your credit report for seven years.

Also, keep in mind that late or missed payments on non-credit accounts can also show up on your credit report. Unpaid utility bills, rent payments, or medical bills may be sold to a collection agency and may then report the debt to the credit bureaus. Bottom line, if you want a good credit score, you have to make every effort to pay your bills.

Pay Down Your Credit Card Balances

This one may seem counterintuitive at first, but it is as important to use some available credit as it is to keep balances low. Credit experts suggest keeping your balances below 35% of the limit. Let us say you have a credit card with a $1,000 limit; 35% of that is $350, so you will want to always make sure your balance is below $350. If you are above 35% now, making every effort to trim your monthly expenses so you can make extra payments towards your credit card balance should be a high priority.

Not using your credit card at all can sometimes be detrimental to your score. If you are not using it, some banks may choose to close your card because they are accruing a small administrative expense by issuing your card and servicing your account. If you are not generating any revenue for them by generating fees paid by merchants when you buy something, they may deem it not worth it to keep your account open. If they close your account, that is one less positive item being reported to the credit bureaus every month, and it may lessen the average age of your credit accounts as well, which is a factor in your score.

Ask For A Credit Limit Increase

Another way to keep your balance low may be to increase the credit limit. If you are carrying a $700 balance on a card with a $1,000 limit, you could get your utilization down to 35% by asking the credit card issuer to raise your limit to $2,000. Now they are not going to raise your limit unless you have demonstrated that you can responsibly use the credit that you already have. Before asking for a limit increase, make sure all of your bills are up to date, and none of your cards are near the current limits.

If you are relatively new to credit and have low limits, after several months of responsible use, most issuers will raise your limit.

Avoid Unnecessary Hard Inquiries

There are two types of credit inquiries. Soft inquiries have no effect on your score and happen when you check your own credit, or when a lender looks at your credit for marketing purposes. Hard inquiries are done by direct lenders and loan agencies before extending credit, can affect your score and occur when you apply for credit.

Be mindful of how often you apply for credit and only apply when you could really benefit from a new credit opportunity. After all, the purpose of your credit score is so the banks have a way of judging responsible credit behaviour. If someone opens a slew of credit cards in a very short period of time, that may indicate they are under financial strain and may not be able to keep up with their payments.

Pay Bills On Time & Automate Payments

Having a long history of on-time payments is by far the most effective way to get a high credit score. Missed or late payments stay on your credit report for seven years, and while the effect on your credit score does diminish over time, it will still be lowering your credit score for all seven of those years. It is recommended that you automate as many payments as you can so you know you will never inadvertently miss one.

If you do find yourself unable to pay on time, communicating with your bank or issuer is a much better option than just not paying. If you call them and explain the situation and how and when you plan to make your payments, most lenders will be quite lenient in reporting a missed payment to the credit bureaus. Communication can go a long way.

Don't Close Old Accounts

After a short time of building your credit history, you will likely have old credit accounts that you do not use anymore. You may want to think twice about closing them, even if you know you will never use them again. Typically the first cards you get approved for have high interest rates and offer no perks. Eventually, you will be getting approved for better cards that offer things like cash back or points that you can use to put towards purchases. Closing those old accounts can actually hurt your score.

One of the biggest factors that goes into computing your score is your credit history length. If you close one of your older credit cards, the average age of all your open accounts will decrease, and this could also decrease your score. If your old, unused credit card carries an annual fee, then typically we would recommend closing the account and taking the minor hit to your score, it will recover after a couple of months.

Use Different Types of Credit

Having a variety of different types of credit accounts will also help your score. The different types include revolving accounts, such as credit cards, installment accounts, such as car or student loans, and mortgage accounts. Many people are trying to raise their credit score in order to get a mortgage to buy a home, so opening a mortgage account may not be an option. But if you only have revolving accounts, it may be a good idea to open an installment account in order to get that reporting on your credit file if you are planning to buy a home in the future. Just be careful not to overspend or be frivolous. Banks want to see responsible use of credit, not a lack of use or irresponsible use.

Establishing Credit

If you have never had a credit account, you may not have a credit score for potential lenders to judge your creditworthiness on, and thus may have a hard time getting approved for a loan. If that is the case, there are some things you can do to get your first credit card.

One easy way to get approved for a credit card when you are new to credit is to get a secured card. A secured credit card is when you make a deposit to the issuer for the credit limit, then you use the card and make additional payments, and when you close the account, you get your deposit back. This may not seem like such a good deal, but while you are using it, you are building credit, and usually within six months or so you will be able to close the account, or more likely, the lender will let you convert the card into a regular credit account and give you your deposit back.

You may be able to get a regular credit card without first needing to get a secured card. If you apply for a card at a bank you already have a relationship with, they may give you a credit card without any history on your credit report. For example, if you have a checking account opened, and they can see a steady paycheck getting deposited on a regular basis, most banks will issue a card with at least a small limit, and then slowly raise it over time.

Fixing Past Mistakes

Maybe you have made some past mistakes with your credit and now are trying to get things back on track. The good news is that with some hard work and dedication, almost any credit score can be significantly improved in a relatively short period of time. There really is no magic to it, the most important thing to do is to get your bills caught up as best you can and start using credit wisely.

Regardless of your current credit situation, whether you have bad credit, no credit, or an established credit profile, you can improve your score over time by responsibly using your credit. The most important things you can do are to make sure your current accounts are caught up, you are not using too much of your available credit on revolving accounts, and try to get at least one type of each account reporting positively to the credit bureaus. If you follow that advice, after a while your score will be high enough for you to be approved for any loan or credit card that you want.