E-Transfer Payday Loans Canada 24/7

E-Transfer Payday Loans Canada 24/7

24/7 Payday Loans in Canada

We know getting your funds fast is important to you. That's why we issue our loans using Interac e-Transfer. This means you get your cash right away. This is much better than EFT loans that some lenders use, as they will only arrive on the next business day. If you apply late on Friday, you might not end up with any money until Monday. What's the point of a payday loan that takes 3 days to arrive?

Furthermore, most lenders only issue their loans during business hours. That can be a real problem if you don't manage to check your email in time. With My Canada Payday, once the contract is in your email you can accept the online payday loan 24 hours a day at your convenience.

Unlike most lenders, we operate 24/7. It doesn't matter when you accept the contract, we will send you the funds within minutes. As long as your bank supports Interac e-Transfer, and virtually every Canadian bank does, you won't have a problem. It's our top priority to get you funds when it's convenient for you and not the other way around.

How does the process work?

Once you have filled out the application form and submitted your banking details through our secure banking data provider, we will send you an email with a link. Clicking the link will take you to a page where you will be shown the contract that details the terms of the loan, as well as an electronic signature box and some terms and conditions that you must agree to.

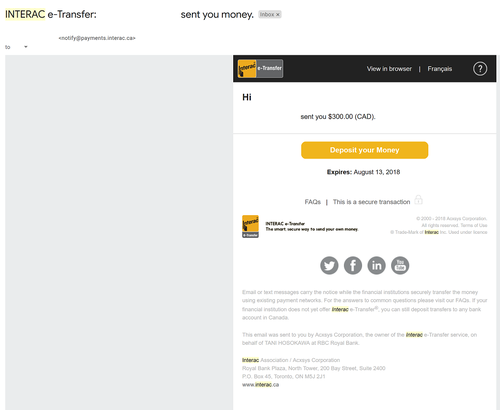

As soon as you fill in the digital signature and submit the form, our systems will automatically dispatch an e-Transfer to the email address you provided in the application process. The email should look like this:

Once you click the link in the email, you'll see this screen:

Choose your bank, and you'll be prompted to enter your online banking credentials. Once you've done that, the funds will be in your account and available for use instantly. No holds, no problem!

What are the qualifications?

With all loans there are certain criteria that a borrower must satisfy. With My Canada Payday, it's easy to qualify for a loans.

Age

The minimum age to qualify for a loan with us is 19 years of age. This is the same in every province that we operate in.

Online Banking

In order to take out a loan, we'll need to see your online banking history. This helps us verify your income, and ensure that your banking health is at a good level without serious problems like many NSF payments.

Income

The minimum monthly income required to get a loan is $1000 per month. This income can come from multiple sources though, and does not have to be limited to just employment income. In particular:

Pension

Pension income counts towards the minimum income threshold. This includes employer pension programs as well as the Canada Pension Plan (CPP).

Child Tax

Even though the CCB payment is typically under $1000, as long as your combined income from all sources meets the threshold you can get a child tax loan with us.

Credit

With many lenders a hard credit check is required to get a loan. With us, in almost all cases we only need to look at your online banking history to make a decision. This means no credit check, which is good for your chance of approval as well as good for keeping your credit score high.

Where do we operate?

We offer loans to people who live in any of these provinces:

- Payday Loans British Columbia

- Payday Loans Alberta

- Payday Loans Saskatchewan

- Payday Loans Manitoba

- Payday Loans Ontario

- Payday Loans Nova Scotia

You'll need to have a steady source of income. That could either be a regular paying job, disability benefits, pension, child tax credits or even CERB. In addition, you'll need to be 19 years of age or older. Bad credit isn't a problem, as there is no credit check. You will have to provide your online banking details in order to apply though. There are no documents to fax over either, since the application process is entirely online.

Do all banks support Interac e-Transfer?

Most banks already support e-Transfers, and if they do then they will also be available 24/7. There are a small number of banks, mostly credit unions, that still don't support Interac however. If you are at one of the "big 5" banks you will have no difficulty getting an e-Transfer though.

Frequently Asked Questions

If we didn't answer your question here, please contact us!